Home

About Us

Page 2

7. Latest Set of Management accounts. Again produced from your accounting software.

|

|

8. Accounts receivables (debtors) and payables (creditors) ageing reports.

9. Principals financial statements. – Particularly required if some form of security is necessary.

If you are a new company, the emphasis is going to be on your business plan , and the security (also called collateral) you or your business can provide against the loan.

You must take the time to practice presenting your case to the bank or lender to iron out any glitches. Practice on your colleagues and family (you never know, they might be so impressed, they'll invest or lend!). It may help to role play the lender and come up with as many pointy questions as possible. The more time you take the better your chances will be. (But remember, don’t fall into the analysis paralysis trap!)

Good luck!

About The Author

Neil Best This article and other useful info such as sample business plans, sourcing and applying for small business grants, and how to find and approach potential investors can be found at http://www.smallbusinessfinancetips.com/small-business-loans.html

|

9 Things You Must Do To Maximize Your Chances Of Obtaining A Small Business Loan

Back to Page 1

Additional Resources

category - Small Business Grants

Historically Underutilized Business Zones - HUBZone Empowerment Contracting Program

How The Government Can Help Your Small Business

Department of Agriculture: Value Added Producer Grants

Small Business Administration's Small Business Investment Companies

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

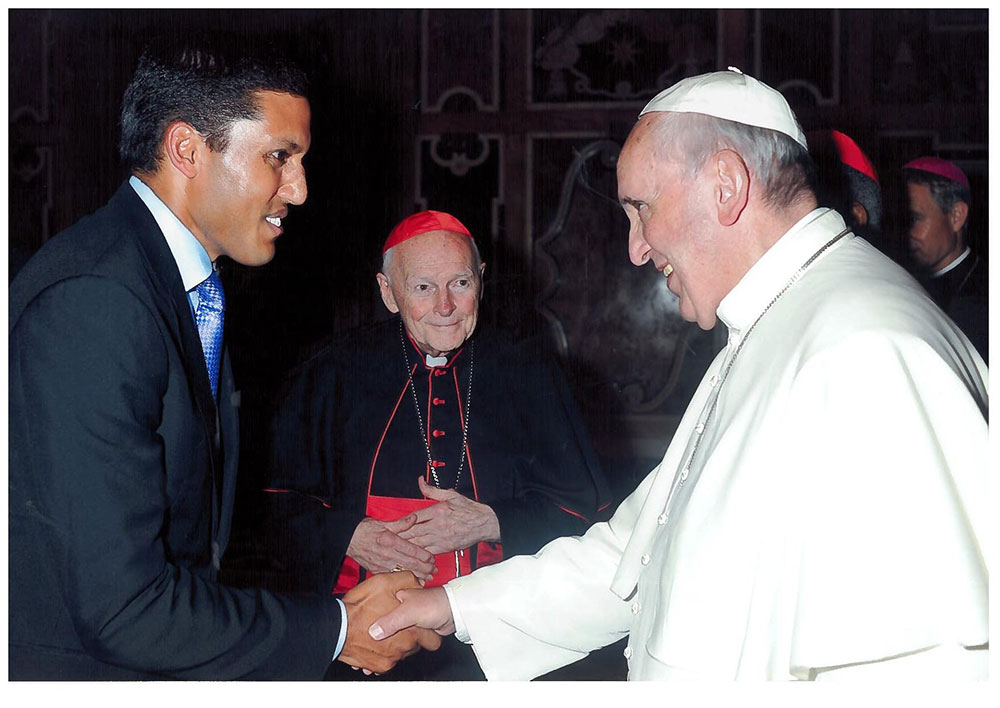

Impact Investing Efforts Unite USAID, Pope Francis

Dr. Rajiv Shah, the Administrator of the U.S. Agency for International Development (USAID) leads the U.S. government’s efforts to end extreme poverty. He chose to participate in the impact investing conference at the Vatican and met with Pope Francis directly to address world poverty, the future of impact investing, and promotion of resilient, vibrant democratic societies worldwide.