Home

About Us

Achieving the Dream Program for First Time Home Buyers in New York

by: Iola BonggayThe State of New York Mortgage Agency, otherwise known as SONYMA, is a public authority that was created in the year 1970 in an effort to provide reasonable and affordable home-ownership opportunities to low and moderate income New Yorkers, especially to first time home buyers.

|

|

The mission of the SONYMA is to offer mortgage programs as well as mortgage credit certificates that will assist first time home buyers in the process of purchasing a house in the State of New York.

One of the programs of the State of New York Mortgage Agency, is the Achieving the Dream Program wherein it seeks to provide eligible low income first time home buyers with really low down payment mortgage financing programs on one or two family dwelling, such as cooperative apartments, condominiums, and manufactured homes that are permanently attached to a real property, at tremendously low and consumer-friendly interest rates.

The key features of the Achieving the Dream Program is its rather low interest rates, the ability to provide financing up to 97% of the value of the property, a very low minimum borrower cash contribution requirement of 1% of the value of the property, 100 and 240 days interest locks for existing housing and houses under construction and rehabilitation, reasonable 30- and 40-year mortgage payment terms, the utter lack of repayment penalties, the provision of down payment assistance amounting to $3,000 or 3% of the total value of the desired property, and ultimately, a reliable payment protection program in the event that the borrower suffers from temporary job loss or accident.

(continued...)

Achieving the Dream Program for First Time Home Buyers in New York

Page 2

About The Author

Iola Bonggay is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. She also maintains Websites providing resources on community grants and health grants. |

Additional Resources

category - Home Buying Programs

Rehabilitation Mortgage Insurance Program

Section 8 Housing Choice Voucher Homeownership Program

Downpayment Assistance Program for First Time Homebuyers in Connecticut

Downpayment Assistance Program for the First Time Home Buyers in North Carolina

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

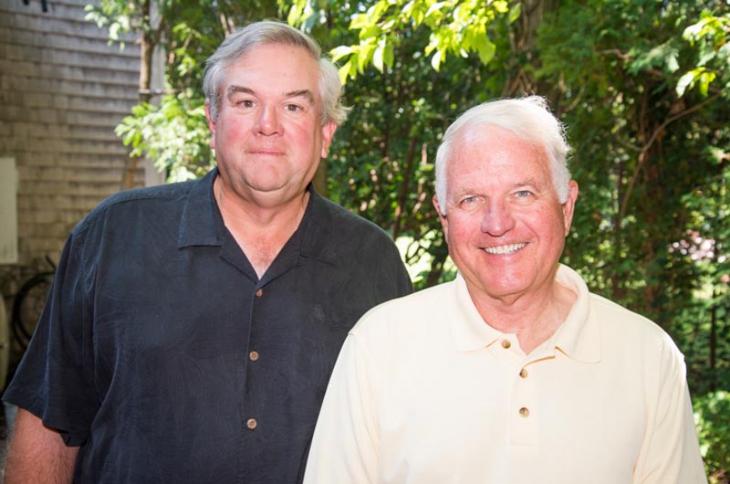

New Vineyard Philanthropy Group Supports Island Youth

MVYouth, a newly formed Vineyard philanthropy group with a mission to support Island youth, will pledge $4 million over the next four years to a diverse set of youth causes.