Home

About Us

Page 2

For over 30 years of providing service and financial assistance to the people of Alabama and has already helped approximately 122,000 families in the process of finding homes they could afford.

|

|

Among all the first time homebuyer loan programs and rental programs of the AHFA are the following:

a) First Step Program - This program is the one of the most popular programs of the AHFA as it offers a 30-year, lower-than-market fixed interest rate to first-time and low- to moderate-income home buyers in the state of Alabama. The funds that are provided under this program are taken from the sale of tax-exempt mortgage revenue bonds to investors by AHFA.

b) Step Up Program - This program is a homeownership program that is designed specifically for moderate-income home buyers who can afford a mortgage, but need help covering the down payment and closing costs. This program is very much similar to the First Step Program as it also offers a 30-year, fixed-rate first mortgage.

c) Mortgage Credit Certificate (MCC) Program - This homeownership program can be used in conjunction with the Step Up Program and has the capacity to provide a direct dollar-for-dollar reduction in federal taxes worth 20 percent of the mortgage interest paid by the borrower each year. The remaining 80 percent of the interest will then be claimed as a tax deduction.

Alabama Housing Finance Authority

Back to Page 1

About The Author Iola Bonggay is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. She also maintains Websites providing resources on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

First Time Homebuyer Programs in District of Columbia

Urban Rehabilitation Homeownership Program for Homebuyers in Connecticut

Downpayment Assistance Program for the First Time Home Buyers in North Carolina

Government Grants within the United States Housing Sector

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Philanthropy as Key Enabler to Work on ‘Wicked Problems’

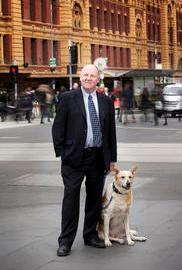

Australia’s Melbourne City Mission Chief Executive Officer Ric Holland writes how philanthropy can act as an enabler on many levels.