Home

About Us

California Homebuyer's Downpayment Assistance Program for First Time Home Buyers

by: TopGovernmentGrants Editorial StaffThe California Housing Finance Agency, otherwise known as CalHFA, is an independent agency in the State of California that has been providing financial assistance to low and moderate income Californians in an attempt to help them seek safe, decent and affordable housing opportunities.

|

|

The programs of CalHFA are constantly guided by its overall agency mission which is to "finance below market rate loans to create safe, decent and affordable rental housing and to assist first-time homebuyers in achieving the dream of homeownership."

In line with this mission, the California Housing Finance Agency has constituted the establishment of the California Homebuyer's Downpayment Assistance Program, more commonly referred to as CHDAP.

The California Homebuyer's Downpayment Assistance Program is a deferred payment junior loan that can be used in conjunction with other CalHFA housing programs. It provides borrowers with funds amounting to 3% of the actual value of the property that they wish to inquire in order to cover the downpayment costs.

The CalHFA has stipulated guidelines that needs to be met when it comes to applying for its programs. In this case, if a borrower wants to qualify for the California Homebuyer's Downpayment Assistance Program, he/she must be:

a) A first time home-buyer (someone who has not owned a home)

(continued...)

California Homebuyer's Downpayment Assistance Program for First Time Home Buyers

Page 2

About The Author

The TopGovernmentGrants Editorial Staff maintains one the most comprehensive Websites offering information on government grants and federal government programs. The staff also provides resources to other Websites with information on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

California Housing Finance Agency

Down Payment Assistance Loan for First Time Home Buyers in New York

Department of Housing and Urban Development: Continuum of Care Homeless Assistance Programs

Department of Housing and Urban Development's Dollar Homes Program

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Philanthropy as Key Enabler to Work on ‘Wicked Problems’

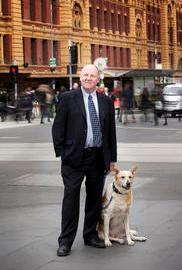

Australia’s Melbourne City Mission Chief Executive Officer Ric Holland writes how philanthropy can act as an enabler on many levels.