Home

About Us

Page 2

a) Downpayment Assistance Program - The ADFA understands that one of the major issues that hinder a first time homebuyer from procuring a home is his/her inability to secure the downpayment and closing cost, which is why the authority has established the Downpayment Assistance Program.

|

|

The program can provide funds in the amount of $1,000 to $6,000 for closing cost assistance, which can be payable for up to 10 years. In order to quality for this program, the borrower first needs to attend a Home Buyers Counseling Program where a certificate will be issued on their behalf.

b) Mortgage Credit Certificate (MCC) Program - A Mortgage Credit Certificate is a direct dollar for dollar federal income tax credit that is provided to the homebuyer. The amount of the credit to the borrower is established by the Mortgage Credit Certificate Tax Rate that is set by the ADFA.

The MCC also works by substantially reducing the federal income tax liability of eligible homebuyers who are purchasing a qualified residence, thereby making more funds available for the house payment or other household expenses.

c) Arkansas Dream Downpayment Initiative - This program is funded by the HOME Investment Partnerships Program, it provides financial support to assist with the upfront costs of buying a home and and at altogether enable hundreds of families to purchase their first home.

First Time Homebuyer Programs in Arkansas

Back to Page 1

About The Author Michael Saunders is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. He also maintains Websites providing resources on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

First Time Homebuyer Programs in Delaware

Keystone Home Loan PLUS Program

Keystone Home Loan Program For First Time Homebuyers in Pennsylvania

How to Get a Government Home Loan with Low or Moderate Income

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Students, Skateboarding and Social Enterprise

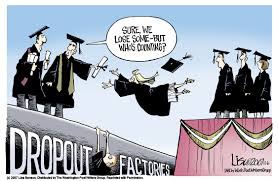

To address the ongoing issue of student dropouts, Toronto District School Board (TDSB) teacher Craig Morrison started a school-business program called the Oasis Skateboard Factory (OSF) to help keep teens stay in school.