Home

About Us

First Time Homebuyer Programs in District of Columbia

by: Iola BonggayThe Department of Housing and Community Development, more commonly referred to as DHCD, is a local government agency in the District of Columbia that is primarily responsible for increasing quality housing and community development opportunities.

|

|

The DHCH operates with the mission of creating and preserving opportunities for affordable housing and economic development, as well as revitalizing underserved communities in the District of Columbia.

The DHCD offers quite an array of programs that are specially designed to assist homebuyers in procuring a safe and affordable homes for their families. The agency's most notable programs are the following:

(continued...)

First Time Homebuyer Programs in District of Columbia

Page 2

About The Author

Iola Bonggay is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. She also maintains Websites providing resources on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

Urban Rehabilitation Homeownership Program for Homebuyers in Connecticut

First Time Homebuyer Programs in Montana

First Time Homebuyer Programs in California

Downpayment Assistance Program for the First Time Home Buyers in North Carolina

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

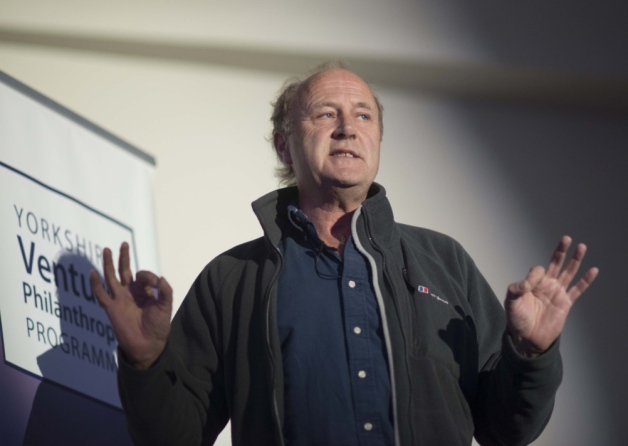

Social Enterprise Gets Investment Boost

Founder of the Eden Project, Sir Tim Smit, supported the Yorkshire Venture Philanthropy (YVP) investment program launch, which is designed to improve funding in social enterprises within the region.