Home

About Us

Page 2

By downloading a grant application package, you can view it offline, giving you the flexibility to complete the application when and where you want.

|

|

************************************

After knowing which information is it that you need. You are now ready to apply. Listed below are the steps you could follow in submitting your application

1. Ask for you housing grant application kit from the HUD.

2. Look into every nook and cranny of that application kit before you actually write anything in it.

3. Make sure you will be able to answer every single part of that application. Do not leave anything blank)

4. No erasures. Please make sure your application is neat and organized.

5. Writing must be done well and must be succinct.

6. Send the application to the right person and agency. HUD will tell you where you are to submit these requirements.

7. If you are required to go the HUD for added requirements, make sure you go on the proper date and schedule and bring the necessary information and IDs they request of you.

Housing grants are very helpful especially when you can’t seem to have that house you have always wanted because of your bad credit record. Most Americans are just not that aware of these grants because the government does not have funds to actually promote their programs.

Just remember to write well and be truthful with everything that you will write in your application. Go and get that grant. Go get your house.

About The Author Michael Saunders has an MBA from the Stanford Graduate School of Business. He edits a site on Government Grants for Small Businesses and also edits HandsNet - A Human Services News Website. |

Government Grants for Housing Assistance

Back to Page 1

Additional Resources

category - Home Buying Programs

State of New York Mortgage Agency

Urban Rehabilitation Homeownership Program for Homebuyers in Connecticut

Keystone Home Loan Program For First Time Homebuyers in Pennsylvania

Ohio Heroes Program for First Time Home Buyers in the State of Ohio

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

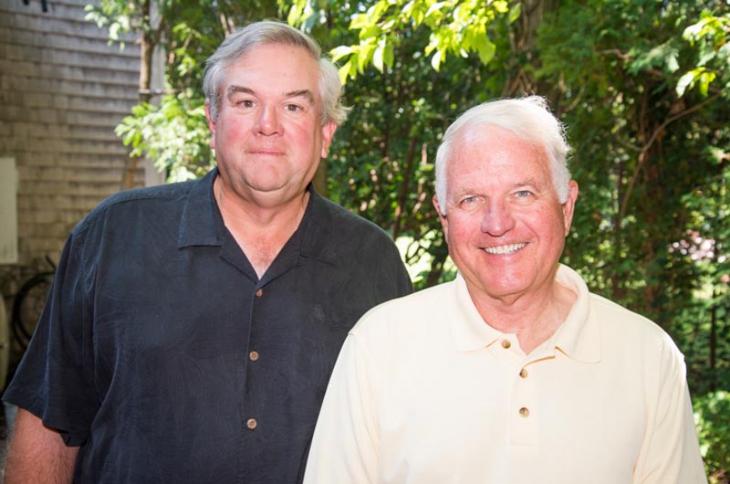

New Vineyard Philanthropy Group Supports Island Youth

MVYouth, a newly formed Vineyard philanthropy group with a mission to support Island youth, will pledge $4 million over the next four years to a diverse set of youth causes.