Home

About Us

Page 2

This program is basically intended for homebuyers whose income is 80% of the area's median income. Also, this loan program is only obtainable through selected nonprofit or government agencies and is only made available to eligible home buyers who work through local agencies under the North Carolina Housing Finance Agency’s New Homes Loan Program.

|

|

In addition, the North Carolina Housing Finance Agency is also offering another beneficial program called the Mortgage Credit Certificate Program. This program allows home buyers who satisfy the qualifying income requirements, sales price, and first-time home buyer stipulations to obtain a Mortgage Credit Certificate which can be utilized in process of procuring a federal tax credit.

This Mortgage Credit Certificate, otherwise referred to as MCC, will work in a manner that enables first time homebuyers to claim 30% of the interest that they pay on their mortgage, which can then be used to pay off their federal income taxes.

Any Mortgage Credit Certificate can be used in conjunction with any mortgage loan program including some adjustable rate mortgages except the NC HFA's FirstHome Mortgage Program.

The MCC will not be offered directly by the North Carolina Housing Finance Agency, instead it is made available by third-party lenders that are working with the agency.

If you wish to read more about this programs, you can contact the NC HFA office or check out its official website.

Second Mortgage Loan Program and Mortgage Credit Certificate for Homebuyers in North Carolina

Back to Page 1

About The Author Michael Saunders is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. He also maintains Websites providing resources on grants for youth programs and home improvement grants. |

Additional Resources

category - Home Buying Programs

State of New York Mortgage Agency

Government Grants for Housing Assistance

First Time Homebuyer Programs in Virginia

Homebuyer Mortgage Program for First Time Homebuyers in Connecticut

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Students, Skateboarding and Social Enterprise

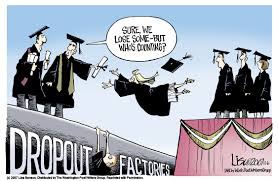

To address the ongoing issue of student dropouts, Toronto District School Board (TDSB) teacher Craig Morrison started a school-business program called the Oasis Skateboard Factory (OSF) to help keep teens stay in school.