Home

About Us

Second Mortgage Loan Program and Mortgage Credit Certificate for Homebuyers in North Carolina

by: Michael SaundersThe North Carolina Housing Finance Agency, more commonly known as NC HFA, is a stand-alone agency operating in the State of California that is generally responsible for ensuring the provision of financial assistance in the form of loans to low and moderate income first time home buyers in North Carolina.

|

|

The programs and initiatives of the North Carolina Housing Finance Agency is constantly tailored to contribute to the realization of its overall agency mission which is "to create affordable housing opportunities for North Carolinians whose needs are not met by the market."

With this mission, the NC HFA has been running several home loan programs that are geared towards the purposes of providing a reasonable housing opportunity for the people in the State of North Carolina.

One of the more popular programs is the FirstHome Mortgage Program for First Time Homebuyers which offer significantly low interest rates and a rather low fixed 30-year mortgage plan.

Together with this program, the NC HFA has also established the Second Mortgage Loan Program wherein it intends to offer second mortgage loans in the maximum amount of $25,000.

(continued...)

Second Mortgage Loan Program and Mortgage Credit Certificate for Homebuyers in North Carolina

Page 2

About The Author

Michael Saunders is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. He also maintains Websites providing resources on grants for youth programs and home improvement grants. |

Additional Resources

category - Home Buying Programs

First Time Homebuyer Programs in California

Rehabilitation Mortgage Insurance Program

Frequently Asked Questions about Buying Your First Home

First Time Homebuyer Programs in Connecticut

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Philanthropy as Key Enabler to Work on ‘Wicked Problems’

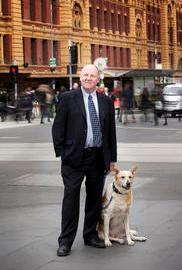

Australia’s Melbourne City Mission Chief Executive Officer Ric Holland writes how philanthropy can act as an enabler on many levels.