Home

About Us

Page 2

To understand this program further, one must first get acquainted with the idea of a secondary market. Simply put, a secondary market is the type of market that makes it possible for investors to purchase assets and securities from other investors, instead of buying them directly from the issuing companies themselves.

|

|

With that idea, the Secondary Market Lending Authority revolves around the working notion of enabling secondary market broker dealers to obtain direct loans in order to finance their inventory of SBA guaranteed loans, which they can then resale in the secondary market.

Small Business owners will then be able to directly avail of loans from the profit organizations that have signed up for Secondary Market Lending Authority Program.

For-profit organizations in the trades of Business or Commerce will be considered eligible to participate in this program.

The Small Business Administration, the principal agency overseeing the Secondary Market Lending Authority, is the country's leading agency that is dedicated to strengthen and maintain the nation's economy by way of assisting, counseling, aiding and protecting the best interests of small business establishments.

Secondary Market Lending Authority Program

Back to Page 1

About The Author Iola Bonggay is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. She also maintains Websites providing resources on environmental grants and grants for youth programs. |

Additional Resources

category - Small Business Grants

Small Business Grants - Support for Veterans

Secondary Market Lending Authority Program

How The Government Can Help Your Small Business

Small Business Administration's Loan Guarantees Program

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Philanthropy as Key Enabler to Work on ‘Wicked Problems’

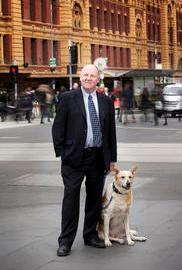

Australia’s Melbourne City Mission Chief Executive Officer Ric Holland writes how philanthropy can act as an enabler on many levels.