Home

About Us

Page 2

1) Borrowers who are Section 8 voucher holders that have been approved by their local Public Housing Authority

|

|

2) Borrowers who are first time homebuyers (people who have not owned or occupied a single residence within the last three years) or borrowers who are non-first time homebuyers but are looking to acquire a home in a targeted area

3) Borrowers whose annual income does not go beyond the limits ($81,000) that are set by the Connecticut Housing Finance Agency

4) Borrowers who have a reputable credit history

5) Borrowers who have a sufficient funds and a stable income to cover long-term mortgage fees

The properties that are eligible for purchase under the Section 8 Housing Choice Voucher Homeownership Program are the following:

1) Existing and new single-family homes, townhouses and Planned Unit Developments

2) Newly built homes that respectively meet the energy efficiency standards which are set by the United States Federal Housing Authority

3) Condominiums that are approved by the CHFA

4) Two- to four-family homes which have been utilized as residences within the past five years; or newly constructed two-family homes that are located in targeted areas

The program can also be used in conjunction with the CHFA's Downpayment Assistance Program. To read more about the program guidelines and application requirements, interested borrowers can visit the CHFA's official website.

Section 8 Housing Choice Voucher Homeownership Program

Back to Page 1

About The Author Iola Bonggay is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. She also maintains Websites providing resources on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

Keystone Government Loan Program for Homebuyers in Pennsylvania

Keystone Home Loan PLUS Program

State of New York Mortgage Agency

First Time Homebuyer Programs in Arkansas

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

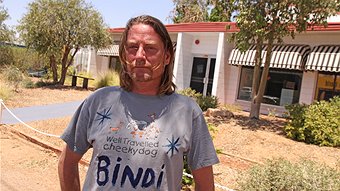

Raised Concerns for Future of Long-Serving Social Enterprise

Employees have raised concerns over the future of disability support organization Bindi, following four staff layoffs that were just recently announced.