Home

About Us

Page 2

Some of the most notable features of the Urban Rehabilitation Homeownership Program are its rather low interest rates which starts at 3.125%** (APR range 3.225 - 3.625%) and a fixed 30-year mortgage repayment plan.

|

|

The program, however, is not open to everyone. Borrowers will only be deemed qualified to participate in the program if they are any of the following employees:

1) State employees with local offices in Bridgeport, Hartford, New Haven, New London, Waterbury and Windham

2) Municipal employees of one of the cities in focus, just as long as the city government agrees to waive the home improvement taxes on the purchased home for five years

3) Employees of private companies who work in any of the cities mentioned above.

The types of homes that are eligible for purchase under the program are single and multi-family homes with price limits that are stipulated by the CHFA. Moreover, borrowers must also have an annual income that does not exceed the limits set by the said agency.

The types of rehabilitation and repairs that are covered by the program are those that involve the correction of structural damages, the elimination of safety and health hazards, the promotion of disabled people's accessibility and energy efficiency.

If you wish to know more about the Urban Rehabilitation Homeownership Program for Homebuyers in Connecticut, you visit the CHFA's official website.

Urban Rehabilitation Homeownership Program for Homebuyers in Connecticut

Back to Page 1

About The Author The TopGovernmentGrants Editorial Staff maintains one the most comprehensive Websites offering information on government grants and federal government programs. The staff also provides resources to other Websites with information on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

Department of Housing and Urban Development: Continuum of Care Homeless Assistance Programs

Can You Use Government Grants to Become A Real Estate Entrepreneur?

Urban Rehabilitation Homeownership Program for Homebuyers in Connecticut

Buying A Home After Bankruptcy - Get A Mortgage Loan After Bankruptcy

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

Philanthropy as Key Enabler to Work on ‘Wicked Problems’

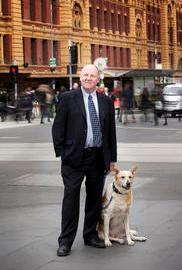

Australia’s Melbourne City Mission Chief Executive Officer Ric Holland writes how philanthropy can act as an enabler on many levels.